Should You Replace Your Windows During a Recession?

With a dropping economy and little money in the bank, many property owners are turning hesitant when it comes to spending considerably on home renovation projects. Aside from having less cash to spend, they also question the return on investment and the payback period.

Luckily, homeowners can achieve both promising instant and long-term investments in energy costs while also keeping their most precious financial asset: their home. Typically, your home will be one of the most significant investments in your life, meaning you should give it the care and attention it deserves. One of the best ways to achieve this is to install new, top-quality windows. Aside from enhancing the beauty of your home, it will also add additional value to your home and energy investments.

Window replacement can also bring new functionality to old and partially functioning windows, and offer a modernized upgrade to your home.

Is Canada Headed Towards a Recession?

The practical definition of a recession is two adverse quarters of Gross Domestic Product (GDP), where people spend less and companies make little and downsize — both temporarily and for good.

According to economists at Canada’s biggest banks, recent fiscal projections predict that an economic recession will occur in Canada in the first quarter of 2023, earlier than was initially projected.

Since 1926, there have been 12 recessions in Canada, as per historical statistics from the C.D. Howe Institute. Luckily, the economy nearly always bounces back.

Although an economic downturn may put pressure on your assets, there are still ways to protect them. Aside from setting up financial protections, you can continue to make an income with a few strategic moves.

Financial Tips on How to Navigate Recession in Canada

With an impending recession, it’s important to stay aware of how to be prepared.

-

Settle Your Credit Card Debt

One of the best ways to ensure easy navigation of the forthcoming recession is to pay off your credit card debt now. It’s crucial to pay off high-interest debt as early as possible, as interest rates will continue to increase in the coming months, making it challenging to manage responsibilities.

Lower balances enable lower interest payments at any time of lost job or income, making it easier to navigate economically challenging periods.

-

Avoid Non-Essential Items

Take the time to analyze your budget and review daily spendings that tend to accumulate. For example, rather than buying lunch daily, consider packing a lunch. Also, check on your monthly subscriptions. It’s a great time to justify your spending behaviours and reassess budgets.

-

Pay Close Attention to Bill Payments and Avoid Paying Late Bills

Over time, these charges can also accumulate. Plan to ensure bill payments are made on or before the due date. Paying charges late can lead to financial penalties, which you always want to avoid, particularly during a recession.

Why Replacing Your Windows is a Smart Investment

-

Energy Savings

Undoubtedly, one of the most significant factors of your utility bill is sustaining the air quality of your home. During the winter, gas bills rise, and during the summer months, your electric bill may skyrocket. Either way, a lot of power and energy is required to ensure a cool temperature in your home.

-

Noise Reduction

Openings in the seals of your home allow for airflow, and air brings with it noise. Old or weak windows are known for this - however, you can bypass enduring these intrusive sounds by replacing your windows.

Aside from offering energy savings, the higher insulating features of modern windows serve as excellent barriers to unwanted ambient noises.

-

Security Enhancement

Complete assurance that your home and family are secure from harm is essential for any homeowner. Installing new windows can go a long way to give you that peace of mind.

For instance, home invaders typically scout for old windows with worn structures. These signs can leave you susceptible and exposed.

-

Functionality

When you first buy your home, the exact placement of its windows and patio doors may not be on your mind. Once you’ve settled in, however, you may discover that your windows need upgrades, particularly in the case of air circulation.

In addition, many homeowners love open-concept living places and blurring indoor and outdoor living. Thus, replacing your windows and patio doors may be worth the investment.

- Warranties

This element tends to be one of the most ignored advantages of having your windows replaced, but it can be a game-changer.

Most modern replacement windows come with relatively broad and lengthy warranties. The industry norm is that the wooden parts of your window are covered for a decade, while glass is covered for up to twenty years.

Replacement windows are more than just a financial investment - considering the visual upgrades and the comfort these new windows can bring to your home, the benefits are endless. If you’re interested in replacing your windows, reach out to a member of our team at Canadian Choice Windows and Doors today!

Average cost of replacing windows

Frequently Asked Questions

How Long Do Recessions Last?

Recessions in Canada have lasted an average of 3 to 9 months.

Do DIY Projects Increase During Recessions?

Yes. During recessions, many homeowners will decide on a do-it-yourself (DIY) approach instead of considering selling or moving. Depending on your credit situation, borrowing to purchase a new home is usually not an option for most individuals during an economic recession.

What Should You Avoid Doing During a Recession?

To make it through an economic recession, some of the actions you should avoid include:

-

Neglecting your savings

-

High-yield bonds investment

-

Ignoring your budget

-

Taking out an adjustable-rate mortgage

-

Investing at high risk

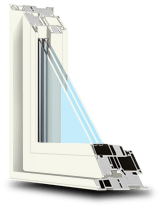

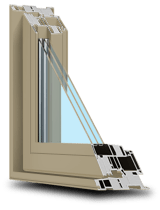

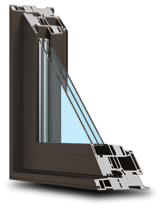

1000’s of Colours & Textured Finishes

Transform your home from ordinary to extraordinary with our new coloured and non-glare textured finishes. Available in a wide array of colours as well as custom matched colours for your very own personalized design.

Our Most Popular Replacement Window Colours:

Take advantage of Canada’s Greener Homes Grant today!

Save thousands off your new window and door installation. Find out if you qualify!